gst claimable expenses malaysia

The GST legislation provides a special concession allowing a taxable person to claim GST incurred on business expenses prior to their effective date of GST registration. In Singapore and Malaysia BL GST code is an example of a non-claimable GST.

The exception is that on blocked expenses.

. The last category includes all purchases where no GST is claimable or no GST is charged. Even though GST is charged on the sales price of the goods or services the amount to be remitted to the Government is only on the value added to the goods or services at each level of the distributionsupply chain. Medical expenses for staff.

Common scenarios - Do I claim GST Ask Jamie IRAS. Fines and penalties Fines and penalties are generally not deductible. Imports under special scheme with no GST incurred eg.

Local Tourism Expenses Image Credit. GST on purchases directly attributable to taxable supplies. The view may change from time to time.

Input tax claims are allowed subject to the conditions for input tax claim. GST is a tax charged on the supply including sales of goods and services made in Malaysia and on the importation of goods and services into Malaysia. Within 30 days Minimum RM1500 Exceeding 360 days Maximum RM20000 Incorrect Returns Maximum RM50000 per offence with potential RM600000 payable on penalties per year Transactional Offences Maximum RM30000 per offence Late.

This article is to summary the GST treatment for condolence expenses in Malaysia. GST on import of goods. Both have the same 12-month accounting period.

Paying Suppliers After Claiming GST After claiming input tax from the Comptroller you must pay your supplier within 12 months of the due date of payment. Basically all taxable persons will be required to account for GST based on accrual invoice basis of accounting ie. However we use the following criteria and conditions to justify the condolence expenses.

Purchases with GST incurred but not claimable Disallowance of Input Tax eg. The supply and therefore invoice should be contracted in the employees name. GST registered businesses may claim GST incurred before registering for GST and also before incorporation provided certain conditions are met.

GST on purchases directly attributable to taxable supplies. GST on import of goods. The following conditions must be met by both the claimant and surrendering companies.

1EXPENSES THAT ARE NOT INCURRED. Taxes Taxes on income are generally not deductible whereas indirect taxes are. Pre-commencement expenses Costs including incidental costs of acquiring improving or altering capital assets.

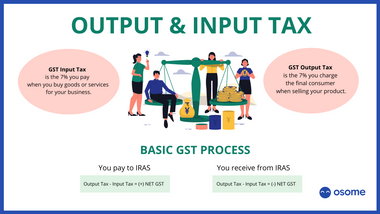

GST code Rate Description. GST incurred input tax would be a deductible expense under section 331 of the Income Tax Act 1967 ITA if the underlining expense to which GST input tax is attributable is wholly and exclusively incurred in the production of gross income and is not prohibited by any provision under section 391 of the ITA. Overview of Goods and Services Tax GST GST is a multi-stage tax on domestic consumption.

Goods Services Tax also known as VAT Value Added Tax in Malaysia is levied on all goods and services even those being imported at every stage of the business supply chain. For partial reimbursements based on 7107 of the amount reimbursed or 47 of the GST incurred on the expenses whichever is the lower. Each has paid-up capital of ordinary shares exceeding MYR 25 million at the beginning of the basis period.

Expenses for use of club facilities Eg. However the good news is that in Malaysia the GST applied is claimable by registered businesses. Up to RM 5000.

The deduction is limited to 10 of the aggregate income of that company for a year of assessment. The GST incurred on such expenses is not claimable. Gst claimable expenses malaysia.

GST is claimable as input tax on the business portion of such expenses incurred. 8 Office equipment for home use eg. Medical expenses for staff.

All output tax and input tax are to be accounted and claimed based on the time when the invoice was issued or received. 47 concession for mobile phones and broadbands fees. However certain categories of taxable persons may be allowed to use the payment cash basis of accounting.

Both must be resident and incorporated in Malaysia. Approved Trader Scheme ATMS Scheme. Input tax claims are disallowed under Regulation 26 of the GST General Regulations.

Purchases with GST incurred but not claimable Disallowance of Input Tax eg. Generally condolences given to a deceased person are either cash condolence advertisement in the newspaper and funeral expenses. The IRAS have proposed specific proxies for businesses to use where it is difficult to determine the actual business portion of the expenses eg.

Green fees buggy fees rental of golf bag locker and dining at club restaurants. Gst claimable expenses malaysia Uparrow Malaysian Gst Enhancement 1st Phase Implementation Home Gst Malaysian Gst Enhancement 1st Phase Implementation September 24 2014 Mohd Imran Gst No Comments Contents Hide 1 Introduction 2 Activating Gst Functions 3 2. Provision of expenses General provision of bad debt Depreciation and loss on disposal capital assets Unrealised foreign exchange loss 2CAPITAL EXPENDITURE.

Malaysia replaced its Sales and Service Tax regimes with the Goods and Services Tax GST effective 1 April 2015. As this is an exception to the normal rule there are of course conditions and restrictions attached to the pre-GST registration ITC claim. To avoid human errors consider coding the expenses into categories 6 taxable purchases 0 taxable purchases reverse charge purchases and purchases where GST is not claimable.

Simply put the tax element doesnt become a part of the product cost. The BL GST code will be used to record the. A medical expense of 10000 incurred with a GST of 600 Based on the Malaysia GST rate of 6.

RM1000 is claimable for domestic travel expenses if you stayed at a registered hotel purchased entrance fees to tourist attractions or tourism packages through local travel agencies registered through the Ministry of Tourism Arts and Culture. Approved Trader Scheme ATMS Scheme. Printer toner monitor chair to facilitate employees to WFH during the COVID-19 period Your company does not own the office equipment No input tax is not claimable.

Purchases with GST incurred but not claimable Disallowance of Input Tax eg. Imports under special scheme with no GST incurred eg. Family benefits for staff.

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Gst Vs Sst In Malaysia Mypf My

Finally Gst Goods And Services Tax Bill Has Been Passed In Rajya Sabha India We Would Be Hel Creative Advertising Goods And Service Tax Creative Branding

All About Input Tax Credit Under Gst Ebizfiling India Pvt Ltd

Malaysia Sst Sales And Service Tax A Complete Guide

Expenses For Which You Cannot Claim Itc Credit Under Gst

What Is Gst And How Does It Work Infographic Xero Nz

How To Start Gst Get Your Company Ready With Gst

Gst Vs Sst In Malaysia Mypf My

Goods And Services Tax Gst In Singapore What Is It

Goods Services Tax In Singapore

0 Response to "gst claimable expenses malaysia"

Post a Comment